Which of the Following Are True for Discount Bonds

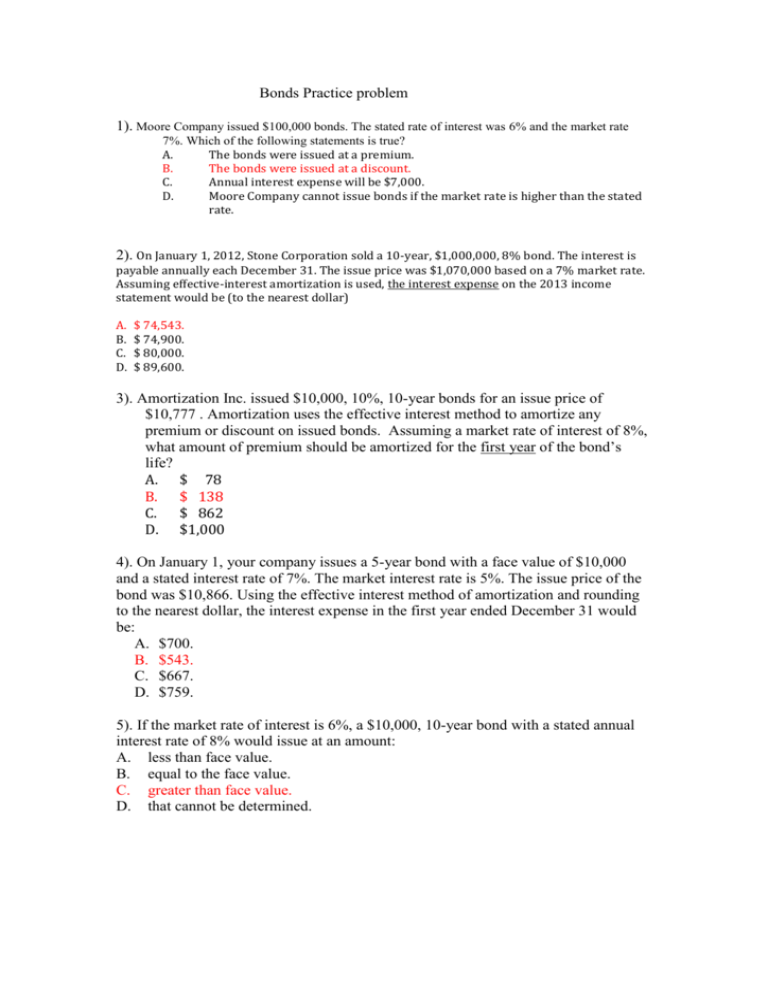

The purchaser receives the face value of the bond at the maturity date. Which of the following are true for a coupon bond.

What Is Discount Bond Pros Cons Fincash Com

B The purchaser receives the face value of the bond at the maturity date.

. The stated interest rate is higher than the prevailing market interest rate. D The purchaser receives the par value at maturity plus any capital gains. B The purchaser receives the face value of the bond at the maturity date.

Neither bond discount nor premium is amortized. For example a bond with a par value of 1000 that is trading at 980 has a bond discount of 20. Treasury bonds and notes are examples of discount bonds.

All of the above. Answer Bond discount is amortized but bond premium is not. A discount bond is bought at a price below its face value.

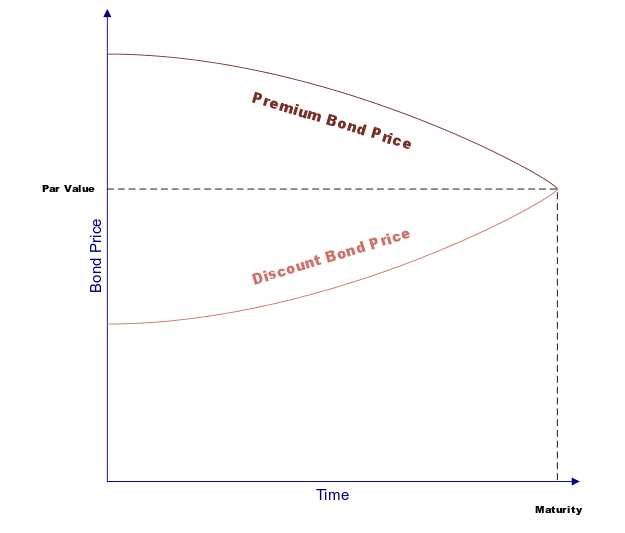

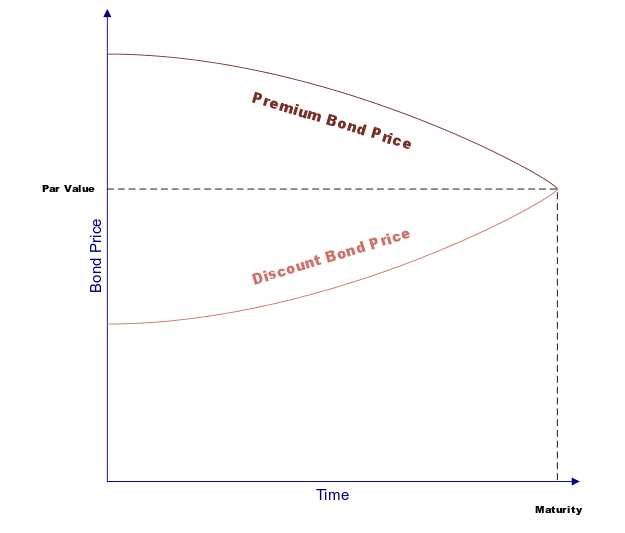

The bond discount is the difference by which a bonds market price is lower than its face value. A When the coupon bond is priced at its face value the yield to maturity equals the coupon rate. At maturity the bond will repay an amount that is less than the face value.

Which of the following are true about Zero coupon bonds more than one may be true. B The purchaser receives the face value of the bond at the maturity date. The bond will be issued for an amount less than the face value.

A Coupon Rate Current Yield Yield to Maturity b Coupon Rate Current Yield Yield to Maturity c Coupon Rate Current Yield Yield to Maturity d Coupon Rate Current Yield Yield to Maturity. Business Accounting QA Library Which of the following is true for bonds issued at a discount. When the market rate of interest is greater than the bonds coupon rate the bond will sell at a premium When the market rate of interest is less than the bonds coupon rate the bond will sell at a discount When the market rate of interest is greater than the bonds coupon rate the bond will sell at a discount The bond price is unrelated to the bond coupon rate and the market interest.

B The price of a coupon bond and the yield to maturity are positively related. 1 Which of the following are TRUE for discount bonds. Zero coupon bonds are issued at below par value E.

Both bond discount and premium are amortized. A A discount bond is bought at par. Depending on the length of time until maturity zero-coupon bonds can be issued at substantial discounts to par sometimes 20 or more.

Which of the following are true for discount bonds. Savings bonds and so-called zero-coupon bonds are examples of discount bonds. Up to 25 cash back Question 1 Which of the following is true regarding bond discounts andor premiums.

C The yield to maturity is greater than the coupon rate when the bond price is above the par value. D All of the above. Coupon rates are always higher than the market rate.

Bonds are a form of debt and can only be issued by the government. Which of the following is true when a bond is trading. 2 Which of the following are true for discount bonds.

CCoupon payments are usually made quarterly. A zero-coupon bond is a great example of deep discount bonds. A When the coupon bond is priced at its face value the yield to maturity equals the coupon rate.

BThe face value or par value for most corporate bonds is 1000. Zero coupon bonds are issued at par value. A A discount bond is bought at par.

Which of the following is TRUE about bonds. AThey have no special provisions. None of the choicesc.

B They typically sell for a higher price than similar coupon bonds. Bond premium is amortized but bond discount is not. 91 Which of the following are true for discount bonds.

Zero coupon bonds are issued at a. The market value of a zero coupon bond is just the discounted value of the final par value payment. II A coupon bond pays the lender a fixed interest payment every year until the maturity date when a specified final amount face or par value is repaid.

Treasury bonds and notes are examples of coupon bonds. 4Which of the following statements is true. The stated interest rate is greater than the market interest rateb.

Which of the following is not true about bonds. 36Which one of the following statements about vanilla bonds NOT. D They typically sell at a deep discount below par when they are first issued.

When the markets required rate of return is less than the coupon rate on an existing bond it is trading at a premium. A A discount bond is bought at par. 1 Examples of discount bonds include A US.

A zero coupon bond pays interest each period B. A The owner of a coupon bond receives a fixed interest payment every year until the maturity date when the face or par value is repaid. If the bond price is greater than its par value the bond is discountedb.

4 I A discount bond requires the borrower to repay the principal at the maturity date plus an interest payment. Group of answer choices PremiumsDiscounts on bonds are amortized using the effective interest method The premium or discount on serial bonds is not amortized. G O it is a contra-stockholders equity account O it is an account that appears only in the books of the investor O it increases when amortization entries are made until it reaches its maturity O it decreases when amortization entries are made until its balance reaches zero at the maturity date.

Which of the following statements is true of a bond that is issued at a discount. A They typically sell at a premium over par when they are first issued. A I is true II false.

I know the answer isnt D When the market rate increases the values of existing bonds goes down. Bonds are discounted using the. This preview shows page 22 - 24 out of 60 pages.

The bond will be issued at par. Only a and b of the above. Treasury bonds and notes are examples of discount bonds.

Which of the following are true of coupon bonds. B The price of a coupon bond and the yield to maturity are positively related. 36 Which of the following are TRUE for a coupon bond.

C Corporate bonds are examples of coupon bonds. Which of the following statements is most true about zero coupon bonds. 2 The yield to maturity is _____ than the.

36Which one of the following statements about vanilla bonds is NOT true. If the bond price is greater than its par value the bond is traded at a premiumd. Business Accounting QA Library Which of the following is true of a discount on bonds payable.

C They are always convertible to common stock. Which of the following is true when a bond is trading at a discount. The market interest rate is greater than the stated interest ratec.

A bond is. E Only A and B of the above.

Discount Bond Bonds Issued At Lower Than Their Par Value

The Premium Bond Conundrum Osborne Partners Capital Management Llc

No comments for "Which of the Following Are True for Discount Bonds"

Post a Comment